Now that we at CNG have completed our Triton XXIV sale, including the electronic session 5 (Electronic Auction 484), I can offer some thoughts on where we see the current market for ancient and world coins. Adding the five sessions of this year’s Triton sale, we had a total sale amount exceeding $14.2 million. This total is about $1.5 million more than the same auction cycle one year ago, which by itself points to a strengthening market. Even more impressive, the total pre-sale estimate for this year’s Triton XXIV sale was approximately $1 million less than it was for 2020. On that basis alone, you could say prices have risen, on average, by well over 10%. This despite (or, in part, due to?) the Covid pandemic, lockdowns, worldwide political unrest, and economic turmoil.

In truth, the situation is quite complex. I will break down how we see things both at the moment and moving ahead through 2021. One thing is certain, however you want to break it down: Now is a great time to consign and a more challenging time to buy. We are actively looking for consignments for our upcoming print sales. Should you choose to consign now, we are very confident you will be pleased with the results.

As for the various market areas, I will break it down into several segments: Collector-driven areas where sales remain strong but within reasonable ranges; investor driven areas where prices are exploding; and collector driven areas that are seeing increased interest.

The Stable Areas

First, let’s explore the rather stable, but rising, areas we cover. Celtic, Roman Provincial, Judean, Sassanian, and Parthian coins all fall into this category. These are largely collector driven parts of the field and prices remain within a stable range and are affordable for most collectors. There are exceptions, generally high grade and rare types which, as always, can explode in price when two or more bidders go after them.

Greek bronzes and Roman Republican coins are stable but rising rather more slowly in value. It appears these coins fall into the category of being up, on average, about 10% from a year ago. The same caveat holds, as above, for rare and high-grade examples. The exception to this would have to be later Roman Republic (after 60 BC) and Roman Imperatorial coinage, which have seen a rather dramatic increase in interest (see below).

Rising Areas

Greek silver and gold coinage have also seen a dramatic rise in interest and resulting prices during the past year. This includes the Classical, Hellenistic and some Oriental Greek areas. This has been a steadily rising part of the coin market driven, it seems, both by increased collector interest, and in some cases by investor interest. Greek coinage is highly artistic and often comes in rather large sizes. They are fun coins to collect, hold, and share at coin club meetings. While prices are definitely up in this area, they have not gotten beyond the means of many collectors. I would say overall prices for high quality Greek coins (Good VF or better condition) are up 15 to 20%. That said, the very high quality (Choice EF to Superb, or what NGC would call Choice AU to Mint State) coins, particularly in popular series (silver decadrachms, gold staters, quality Hellenistic portrait tetradrachms, and others), are all exploding in price. In many instances, these coin types are up 50 to 100% from just as recently as a year or two ago. See some of the prices realized below! We think this area of collecting will continue to see strong, if not increasing, prices.

Roman Imperial coinage is somewhat of a mixed bag. This is still largely a collector-driven area of focus, but overall prices are certainly up 10 to 15%. Curiously, at the lower end of this market, prices are up perhaps even more. Where recently you could buy a worn denarius for $75, it might now be going for $100. This may not seem dramatic but if you have $300 to spend in an auction, it means you can now buy three coins instead of four.

Better emperors (both in popularity and rarity) and better reverse types are garnering prices that are probably up 15 to 20% from a year ago. Roman gold has finally started to awaken from a years-long doldrum. Many Roman aurei are common enough to be considered collectible. Assembling a set of twelve Caesars in gold is a reasonably possible thing to do. Yet at the same time, some Roman gold is extremely rare, and these coins are awakening to both a collector base and an investor base. I would call the lower end Roman gold market stable to up perhaps 10 to 15%. The higher end Roman gold market has risen perhaps a bit more as well in the past year. It’s just that a difference in what 10% means on a $2,000 coin isn’t so exciting as it is on a $200,000 coin. Since Roman gold was relatively flat between about 2014 and 2020, after spiking between 2004 and 2014, this is a market correction that I think has been long overdue and I expect it to continue.

The Exploding Market

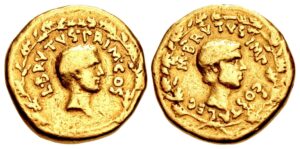

As previously noted, Roman Imperatorial coinage is exploding in value. As an example, one of the great Triton XXIV coins from the wonderful collection of Peter J. Merani was lot 54, an extremely rare gold stater of Brutus. One of only nine examples known, with only three in private hands, it was in Fine condition – one might term it a true collector’s coin, rather than the flashy Superb or Mint State pieces typically chased by investors. Considering the rising interest in this field, we estimated this piece at $150,000, which earned us a few raised eyebrows – why so much for a coin in only Fine condition, which sold in Triton III in 1999 for only $27,000 hammer? In the end it hammered for $280,000 – $336,000 with buyer’s premium – more than double the estimate and over 10 times the Triton III price. In this instance, the coin’s great rarity and immense historical importance trumped its rather humble condition.

It would seem that those coming back into ancient coinage have familiarity with ancient history that begins during this timeframe and then continues into the Roman Imperial era. These likely newly returning collectors have caused prices in this area to increase 20% or more in the last year. It seems everyone wants a coin of Julius Caesar (as an example).

Byzantine coinage ends my discussion on the ancient part of the market. And what a place to end. Byzantine coin interest has literally exploded. Many prices are up 50 to 100% (or more) from as little as a year ago. Byzantine gold is, in general, quite common. Enough so, that it is an easy field to enter and enjoy without breaking the bank. Yet, like Roman gold, completeness of a collection requires the addition of several rarities. It seems we have a broad base of collectors who are in both parts of this process. Common VF solidi that were bringing $300 a year ago now commonly sell for $450 to $500. And EF solidi that were bringing $500 to $700 a year ago are now bringing $1,000 to $1,500. Silver is equally popular. Only the bronzes seem to be lingering near prices from the recent past. Nothing seems to be slowing this part of the market down.

The World and British Coin Arenas

Turning to the “non-ancient” world, medieval coinage is a mixed bag. This coinage is highly collector driven with the exception of a few popular rarities. Prices are stable or up slightly. As a fan of Bracteates, I am surprised this field hasn’t grown in value more quickly along with others. I think it is because the coinage is difficult for a beginner, or investor, to understand. It takes a scholar to know these coins. If you are one, my expectation is you can find good value here.

World coinage has been generally strong. Large silver – talers, crowns and the like – from the German States and France seem to be gaining in popularity, likewise the New World. Central and Eastern Europe seems rather flat at the moment, perhaps presenting a buying opportunity. Some areas of world gold are also seeing strong increases. We don’t specialize in machine struck coinage (except of course more recent British coinage) so my comments are generally limited to the prior era. Quality and eye appeal are seeing strong increases in price. This part of the market is following the general trend and seems to be up roughly 10% overall.

Finally, ending with British coinage, I think it is safe to say this field is also seeing a renewed and strong collector influence. Prices are trending upward in the 10 to 20% range. One of the things that makes this field so popular is the uninterrupted line of rulers who can be collected and studied. It’s one of the few fields where you can span more than a millennium of uninterrupted rule over a single realm.

Conclusion

In conclusion, what we are seeing is undoubtedly the impact of the pandemic-restricted world we live in. People from all walks of life are finding themselves in the same situation – stuck at home looking for things to do. And for many, that means rekindling old hobbies. Bring out the old coin collection, dust it off, and fill in some holes you had forgotten about. For those of us who have been steady collectors, it means the room just got a little more crowded. For those that are coming back into the field, or entering it for the first time, welcome aboard! You will quickly find you are among friends – just don’t bid against them!

At the same time, in times of economic distress, people looking to preserve or enhance their wealth tend to grab and hold onto tangible objects of demonstrated long-term value, whether it is gold bullion, real estate, or collectible coins. Furthermore, ancient and world coins have the advantage of being a worldwide market, popular everywhere, not in any one particular country. This is perhaps the major factor in the price spikes we are seeing in high-end coins.

Outlook

Despite progress with vaccines and treatments, it is quite possible we are stuck in a restricted and isolated world for much of this year. I think coin prices will remain strong and probably continue to increase. Our hope is these new, and renewed, friends, will hang around into the future. Only time will tell.

As for me, I could sure use a coin show about now. I am missing seeing so many of you and just having the chance to talk: about coins, family, even politics and the weather. If any of you wish to chat via Zoom, all you have to do is let me (or any of the numismatists) know. We would love to catch up and actually see you face to face (sort of) sometime soon.

Let me know if you wish to discuss any of the above comments further. And please let us know if you are interested in consigning to an upcoming auction. The time may never be better!

Here you can see Michael Gasvoda’s spring 2019 market report.

For more information on the auction house go to the CNG website.

In this review you will find the top results of Triton XXIV.