Mark Salzberg, Chairman of the Certified Collectibles Group, recently shared his thoughts on the current crisis and its effects on the collectibles industry. We hope you will find his letter as interesting as we did.

My Friends and Colleagues in the Collectibles Community: I have been in the collectibles industry for more than 40 years. In that time, I have seen many market peaks and valleys – periods of prosperity as well as periods of great difficulty. In fact, I became a coin dealer during the boomtimes of the late 1970s, only to experience the great crash of 1980 and the ensuing multi-year slump.

During each of these challenges, I have learned that there are opportunities for those who can adapt quickly. This crisis is no different.

Making Online Sales as Safe as Possible

The cancellation of shows and comic cons as well as the closure of shops have dramatically and abruptly changed the global collectibles industry. Even in the Internet Age, many collectibles dealers have made their living through face-to-face interactions with other dealers and the public. With that dynamic gone for the foreseeable future, their survival – and the survival of our markets overall – rests on being able to sell collectibles online to a broad base of buyers around the world.

Online sales of collectibles have long been facilitated by third-party authentication, grading and encapsulation. Now, expert and impartial certification services are even more important, providing critical confidence and liquidity to the collectibles markets.

Third-party certification from NGC, PMG, CGC, ASG and CAG makes it easier for collectibles to be bought and sold online, even sight-unseen, because people understand and trust the descriptions and grades of the collectibles. These transactions are also safer because the collectibles are backed by comprehensive guarantees and protected by state-of-the-art holders.

Imposing Safety Measures from the Very Beginning

Recognizing that our services are essential to the global collectibles markets, we took numerous preventative measures upon seeing the outbreak of the coronavirus in China, where we have a large presence. As a result of our proactive efforts, all of our worldwide locations have been able to remain open and provide uninterrupted services to collectors, dealers, auction houses, museums, banks and others.

Our Shanghai office was our first location to face the coronavirus outbreak. We quickly responded by increasing cleaning and disinfecting of workspaces, distributing masks and sanitizers to all employees, discontinuing the use of any shared devices such as coffeemakers and requiring that all employees have their temperature taken before entering our facility.

As we saw the coronavirus spread rapidly in Asia, we expanded these preventive efforts to our other offices. We instructed all employees who could work from home to do so, even before governments implemented such guidelines. We expanded flex and sick time, stopped in-person pick-ups and drop-offs from customers and took other steps to improve safety.

For more than six weeks, only the employees who are absolutely required to work inside of our facilities have been there, and they are able to spread out to safe distances of six feet or more as recommended by the Centers for Disease Control and Prevention (CDC). Daily distribution of masks and gloves, frequent cleaning and other safety protocols continue to provide additional protection for our employees.

Collectibles Markets Are Strong Despite Crisis

Amid this new normal, the collectibles markets are showing incredible signs of resiliency. Coins certified by NGC, notes certified by PMG and comics certified by CGC have achieved very strong prices at recent auctions, and many dealers are reporting brisk sales.

For example, during the week of March 16 – the peak of stock market volatility in the US – Stack’s Bowers Galleries sold the PMG-certified D. Brent Pogue US currency collection for more than $9 million. An incredible 27 PMG-certified notes achieved prices of at least $100,000, including an 1863 $100 “Spread Eagle” Legal Tender note graded PMG 65 Gem Uncirculated EPQ that sold for $432,000.

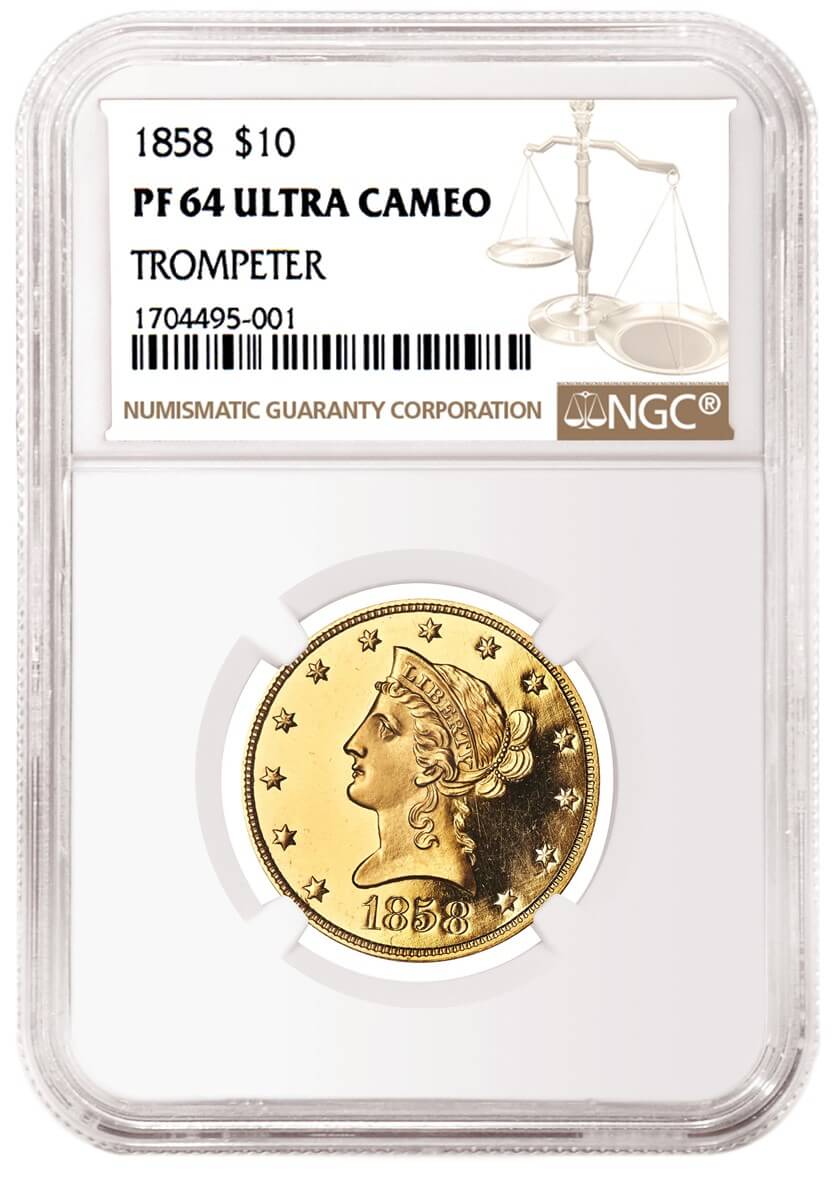

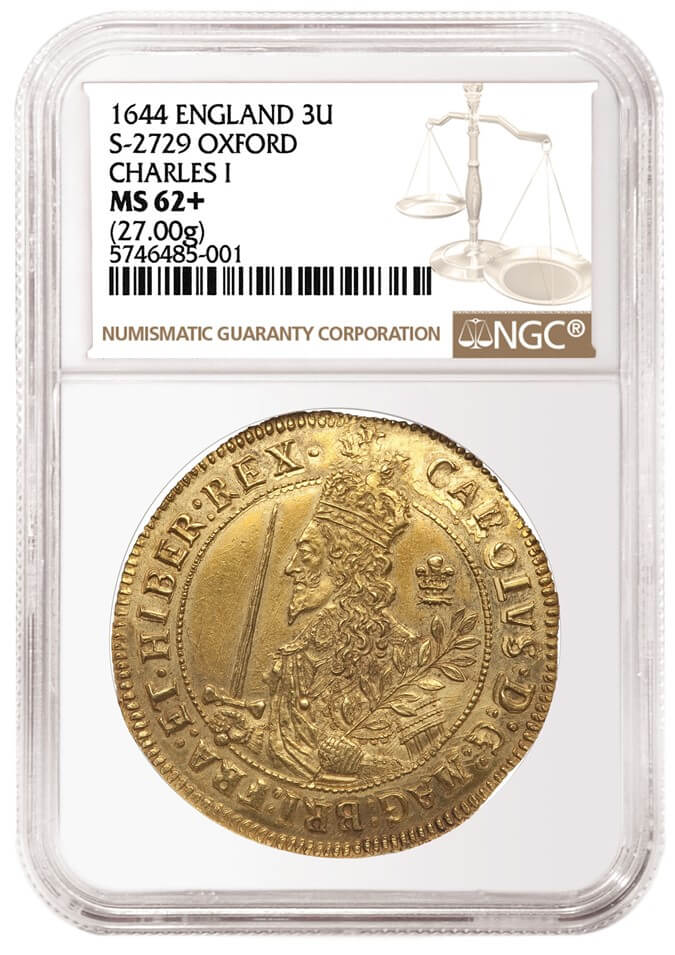

Last week saw amazing results in several sales by Heritage Auctions. On April 23, Heritage sold an 1858 Eagle graded NGC PF 64 Ultra Cameo for a jaw-dropping $480,000. The next day, Heritage’s world and ancient coins sale was topped by a 1644 England Triple Unite graded NGC MS 62+ that sold for an incredible $360,000, while its paper money auction was led by two 1934-dated PMG-certified notes that realized more than $100,000 each.

Heritage Auctions also just held a major comic book sale that ended May 3. The top lot was an Amazing Fantasy #15 (Marvel Comics, 8/62) graded CGC 8.0 that realized $180,000 – well above its Overstreet value.

A Shift Towards Collectibles

Retailers who sell collectibles on TV and over the phone also report substantial business in the current climate. With many employees working from home and reduced rates for advertising, their costs are down, and they are able to more quickly adjust to meet demand.

All of this is not to say that we are immune to the economic downturn experienced by many companies and industries. Mints around the world have temporarily stopped issuing collectible coins and Diamond Comic Distributors has temporarily stopped distributing new comic book titles.

While we have seen submissions decline in the US and Europe over the last six weeks, we are confident that this situation will be short-lived. Indeed, our mainland China business recovered quickly and is actually up compared to the same period last year.

The encouraging results from online, TV and phone sales reveal that interest in collectibles is robust. Gold is approaching record highs and there is extraordinary demand for bullion – the premiums paid for physical gold and silver as compared to spot metal prices are the highest I have seen in my career.

Meanwhile, seemingly limitless amounts of paper money are being printed in the US and elsewhere, while stock markets have shown nerve-wracking volatility.

Not surprisingly, we are now seeing a dramatic shift in asset allocations that will only accelerate in the coming months. Investors, who have become much more wary of the stock market and currencies, will shift a greater portion of their assets to collectibles, which continue to become increasingly liquid and fungible as a result of third-party certification.

When mints, distributors and shops begin to reopen, we expect to see a sharp increase in both collectibles sales and submissions as the current logistical and commercial impediments are lifted.

Although it may be some time before shows resume, I am excited to announce that we have partnered with Heritage Auctions to serve this important role for the dealers whose businesses depend on these events. Soon we will offer Invitationals where the country’s most active dealers can trade collectibles and submit them for on-site grading.

We will work closely with Heritage to ensure that these Invitationals are safe for all participants. Currently, we plan to hold six events for coins in the next year, and we are formulating our plans for paper money and comic book events. I am thrilled that we are working together to provide additional liquidity and capital for our dealers. Look out for more details soon.

While there remains a great deal of uncertainty about the coronavirus and its economic impacts, I am extremely confident that the collectibles markets will see an extraordinary period of expansion in the near future. Dealers who can deliver convenience, safety and liquidity through a robust online presence will not just survive but thrive in the new normal.

Now and always, the CCG companies are here to help with expert, impartial and trusted certification services. No matter how far apart we may be, know that we are here for you.

I hope that it is not too long before we see each other at a show again. Until then, please stay safe.

Find more information on the website of the Certified Collectibles Group.

In 2019, Mark Salzberg was granted the Harry J. Forman Dealer of the Year award of the ANA.

Mark Salzberg isn’t the only one who shared his thoughts on the current situation, here you can find out what French art dealer Anthony JP Meyer reports about the art market.

By the way, NGC already pointed out in April that the coin and banknote markets show strength amid this global crisis.

And if you’re interested in the effect of the pandemic on the coin producing industry, you should definitely read our Mint News Quarterly Special Issue. Click here to download the issue for free.