In the numismatic world, just what does the term legal tender mean when collector coins are involved – what to know before collecting, investing… or spending. This says it all and it has compelled many coin collectors and bullion investors to ponder this poignant question over the last five or so years and exactly why. The reasons are both simple as well as perhaps being somewhat complex but primarily, the question is raised due to the minting and marketing of a particular range of collector coins. These products reared their controversial head once again in the United Kingdom recently when it was reported a man in Exeter, England attempted to use a silver collector coin with a face value of £100 as a means of payment for fuel and was summarily arrested at the petrol station. We’ll get back to this part of the story in due course but first, some background on the range of coins and then we can determine what all the fuss was about.

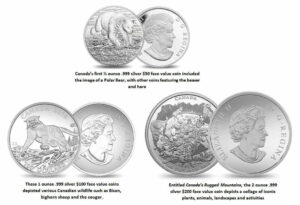

A decade ago, national Mints such as the Royal Canadian Mint and Royal Mint in the United Kingdom devised a product which involved striking pure silver coins in various weights with corresponding denominations. Aimed at both modern coin collectors and investors, they depicted a selection of themes and designs such as wildlife, national anniversaries and landmarks. The program was simple – collectors and/or investors can purchase the coin for their face value, $200 for $200 in Canada or £100 for £100 in the UK – no additional surcharges or premiums. What could go wrong… it is money issued by national treasuries and they are minted in precious metal such as pure silver.

Legal Tender Status – But Not For Payment

Issued in denominations of $20, $50, $100 and $200 in Canada and £20, £50 and £100 in the United Kingdom, the silver content ranged from a quarter ounce for the $20 coin to two ounces for the $200 and £100 options. Well, as they say – no good deed goes unpunished and soon after these coins were released, many people began to experience buyer’s remorse and looked for ways to return, spend or exchange their coins. The scenario was made worse when collectors attempted to deposit them in their bank accounts.

Extreme case in point – a man in the UK had purchased £29,000 worth of the £100 silver coins in 2019 with an incentive of earning loyalty points using his American Express card. His plan was to buy the coins, collect his points from the card company and routinely deposit the coins into his Bank account at HSBC. One slight problem with his scheme, the bank was advised by the Royal Mint they were not obliged to accept the coins. They may have a legal tender status but are essentially issued by the Treasury for collector purposes and not intended as a means of commerce or payment. Thus, HSBC exercised their right to refuse the man’s deposit – the story made headlines and he was “stuck” with £29,000 worth of £100-denominated coins or just a little over £10,000 in silver bullion. It was a hard lesson to be dealt and many commented it was all about greed.

But, regardless of this man’s motives, it would have been helpful from the very start if these coins came with an advisory or warning on the marketing material. In most cases, holders of these coins were in for an even worse shock when the option of selling them for their intrinsic value would have meant a huge loss. The $200 Canadian face value coins contain two ounces of .999 silver with a current melt value of 48 US dollars. The loss would today equate to 112 US dollars taking into consideration the exchange rate of the Canadian dollar and the spot price of silver.

The British counterpart isn’t as dire since the £100 coin also contains two ounces of pure silver but the exchange rate for the pound means a loss of $89 or £64 per coin. In order for the coins’ face value and metal content to have any monetary relevance, the spot price of silver would have to increase to at least $70 to $75 in order to accommodate either the Canadian $200 or the British £100 coins.

To aid collectors and investors, an advisory should have stated the coins are NOT intended to be used as currency and cannot be redeemed at Banks and Post Offices as with ordinary £2 or £5 commemorative coins. The process for redeeming these high value coins ostensibly is to bring them to Her Majesty’s Treasury in the United Kingdom. Hence the problem as ordinary citizens do not have easy access to the Treasury and, the Royal Mint was eventually forced to release an important caveat via their press department. Despite them having developed the concept, theme, design and production, they are essentially just the manufacturer as well as the direct retailer but are not liable for their redemption.

Why the UK Did Not Mint High Face-Value Silver Coins After 2017

Ultimately, these coins soon fell out of favor with collectors as it was eventually realized they did not truly represent value for money – the denominations were far too high or the metal content was not sufficient enough to warrant the face value, either description would be applicable. Poor reviews and diminishing sales eventually resulted in no additional high face-value silver coins being minted or marketed after 2017 In the UK. The Royal Mint instead released more traditional bullion related coinage such as the Queen’s Beasts series with symbolic denominations that have remained popular with collectors and investors alike.

Why You Should Not Pay Your Petrol With A Collector Coin

Now, we’ll go back to the man who had experienced legal troubles for daring to use coin of the realm (or so he thought) for a fuel purchase in July. The total cost for the petrol amounted to £60 and he attempted to offer a silver £100 coin depicting a scene of Trafalgar Square on the reverse and minted in 2016 as payment. The petrol shop manager most likely knew nothing about these coins with a mintage of around 50,000 pieces and believing he may be dealing with a thief, phoned the police who arrested the fifty-four-year-old man, charging him with attempted theft of said petrol. After a four-hour interrogation of the man who is in fact a coin collector came to an end, having adequately explained he had previously used similar coins in the past. Curiously, the man it seemed was no stranger to this particular type of interrogation as he admitted having had a similar incident in 2014 when trying to pay for petrol with five £20 silver coins.

The authorities after further investigation eventually came to the conclusion, he had not attempted to steal petrol and was advised by letter he would not be charged with theft – case closed. Had he been prosecuted and convicted of the charge in question, he might have faced a fine of £5,000 or possibly a custodial sentence. However, the coin collector as we say “turned the tables” and filed an unlawful arrest suit to which the Judge found in his favor and was instead awarded the sum of £5,000 in damages against the local police district. The damage referenced was “failing to receive an adequate apology or an assurance the incident would be removed from the police national computer”.

The case was decided on the fact that in the United Kingdom, a person cannot be sued for a debt if they attempt to pay with currency having a legal tender status and that in England and Wales, coinage produced by the Royal Mint of any amount and issued by HM Treasury is deemed legal tender throughout the UK as per the 1971 Coinage Act. As such, a court would see them as an acceptable mode of payment, although it is at the discretion of the shop in question as to whether they will accept collector coins or not.

We’re assuming these damages were paid in legal tender currency, though no word about if the £60 petrol purchase at the heart of this dispute was ultimately made good by the customer or whether the £100 coin at the heart of the matter was returned to him. It has been rumored the man, a carpenter by trade commented to a national tabloid that he may buy more of these high-value coins with his award. That may be more a case of a fool and his money soon being parted, though how long we might have to wait for the next instalment in this saga is anyone’s guess.

The author, Michael Alexander, is president of the London Banknote and Monetary Research Centre.

Michael Alexander regularly publishes articles in CoinsWeekly, recently he wrote about the withdrawal of the legal tender status of the old British £20 and £50 notes.

If you want to know exactly what legal tender, bullion coin or challenge coin means and what the difference is between a commemorative coin and a commemorative circulation coin, don’t miss this article at Cosmos of Collectibles: What is the difference between a coin, a commemorative coin and a medal?

And, by the way, of course it’s a completely different story if you try to pay with historical rare coins in a shop as a young couple did in Los Angeles. Particularly if you stole those coins …