Why Is US Coinage so Expensive?

Issues from the United States of America are the most expensive coins in the world – at least regarding pieces with outstanding grades. There is a good reason for this phenomenon. The US market is an investors’ market. This also means that dealers cannot afford to refrain from having a high-quality coin graded by one of the well-known coin grading services. If the specimen is not graded, it will realise a significantly lower result. The reason for this is that Greysheet acts as an independent market analyst that regularly sets an average price for all the grades of the Sheldon Scale. This enables investors to know whether the current trend is upward or downward. It also means that a buyer is no longer in need of numismatic expertise to make a well-informed decision. Greysheet and the grading institute will make sure they purchase the right piece. In other words: anyone who wants to invest in coins will find that the market for US coinage is extremely transparent. And investors like that.

Why Was Swiss Coinage so Affordable?

Before Olivier Chaponnière’s catalogue of Swiss gold coins, the situation was different in Switzerland. The much-used HMZ catalogue only mentioned prices for a few, rather roughly divided quality segments. In addition, authors usually did not give a specific price for rare coins of above-average quality, only mentioning that the piece was sold at a “collector’s price”. This did not help the market. Especially when it comes to coins that are of interest to investors, a profound knowledge of the matter is needed to make sure you pay a price that is in line with market conditions. That is no problem for collectors. But it is an impossible task for investors. Therefore, investors tend to stay away from this market. With the exception of a few speculators that expected particularly rare pieces to increase in value, the market of Swiss gold coins is clearly dominated by collectors.

What Makes Olivier Chaponnière’s Work Revolutionary?

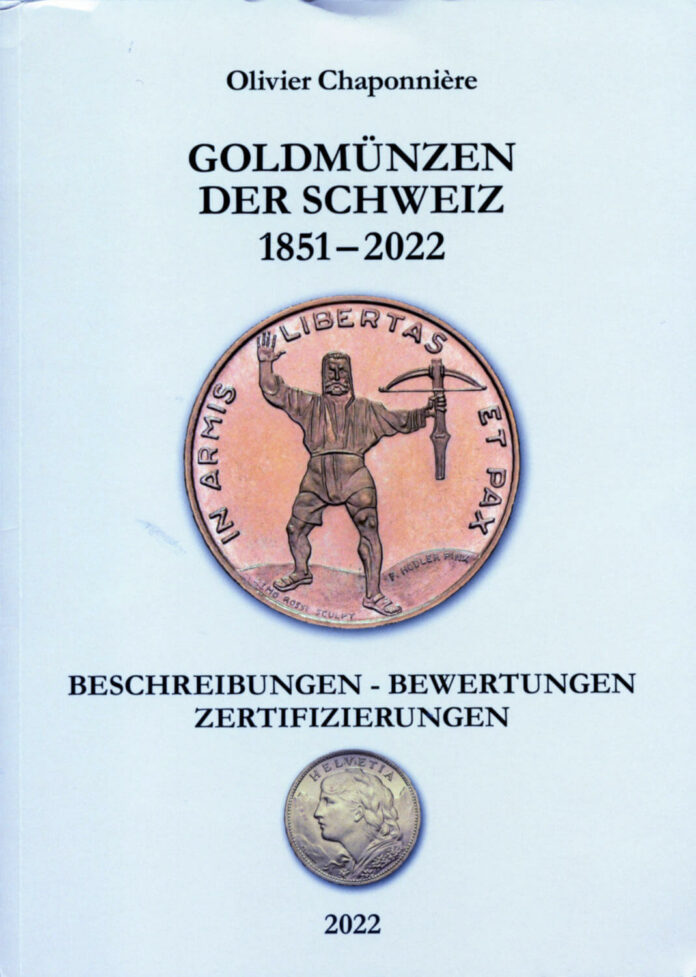

Thanks to Olivier Chaponnière’s work, these “good old days” are over and done with. He wrote the first catalogue that presents Swiss coins in the same way authors present US coins. Especially regarding top grades, he mentions how many specimens of a specific coin were graded by NGC and PCGS and gives an appraisal. So far, only a few Swiss gold coins were graded – but this is to change quickly. The specific prices and, above all, the significant difference between the price of a piece graded MS60 and one graded MS70 makes it very attractive to have one’s gold coins graded for the sake of optimising profits.

Let me illustrate this with an example. There are the famous Gondo gold coins, of which very few pieces were created in the years between 1893 and 1895. So far, Gondo gold was simply Gondo gold. Now, there is a substantial price difference between MS60/61 (estimated market value: 75,000 euros) and MS67 (estimated market value: 200,000 euros). Although this is just an estimate for the time being. Indeed, so far only two 20-franc pieces made of Gondo gold have been graded (both of them MS62).

But there will definitely be many more graded pieces in the future! After all, the human being is a greedy creature. And if there is a chance to make more money from selling our coins, we readily invest the relatively low cost of a grading.

The Swiss Market Loses Its Innocence

I know it already: there will be a hail of letters to the editor written by coin enthusiasts who complain about the American bad habit of sealing coins into plastic coffins. I admit that I am always a little amused by this naivety. As if someone would ask us whether we do or do not approve a worldwide development. We will not stop slabs – at least in the field of machine-made coins of the 19th and 20th century. Those who do not play along out of conviction will get a considerably lower price for their coins because international investors will not participate in the sale. The new owner will have the piece graded and then get much more money for it because the international investors’ market simply prefers to buy graded pieces. And then, the person who did not want to put their coin inside a plastic coffin will feel like a fool.

No wonder that distinguished persons such as Mark Salzberg, the CEO of NGC, Stephanie Sabine, the PCGS President, and Marius Haldimann, CEO of Swissmint, contributed a few words each to Olivier Chaponnière’s catalogue. They are the winners of his work, together with all those who already own Swiss gold coins of outstanding quality, and with all the coin dealers who will get a higher commission for the same work thanks to higher prices.

And rest assured: prices of Swiss gold coins will increase once the international investors’ market discovers them. There is a good reason why Olivier Chaponnière had his catalogue translated from French into German and English for international readers.

It remains to be seen whether American grading services will succeed in setting up grading institutes in Europe. The long waiting period that currently comes with sending your coins to the headquarters in Sarasota are counter-productive given the short amount of time that is available between consignment and the auction sale. This might slow down the development, but it will not prevent it.

Price Fluctuations Are Part and Parcel of Any Investors’ Market

However, there is one thing we should always keep in mind with regard to markets that are driven by investors: prices may fall just as quickly as they increase. Turning coins from collectibles to investment objects will come with significant price fluctuations. And that is why the market for Swiss gold coins has lost its innocence with this quantum leap in cataloguing.

The book can be obtained directly from Chaponnière & Firmenich.