How do you get teenagers to start collecting coins? And how can you encourage novice collectors to get into a new topic, infecting them with the “collecting virus” and turning their hobby into a passion? Especially in times when established collectors have the feeling that their hobbyhorse becomes more and more expensive? If you ask a coin collector whether their hobby has become less affordable in recent years, they will nod in agreement even before you can finish the question. But besides emotional assumptions shared by the collecting community, it is hard to actually confirm this sentiment. Therefore, it is all the more astonishing that, to this day, there is no sustainable method of measuring the price development of coins that could reflect this upward trend.

How Do the Prices of Coins Change?

This also means that there are no suggestions available as to what topics new collectors should focus on. There is no price indicator – which should ideally be available online – that tells you what an acceptable price for the coin in question looks like. Although attempts were made to show the price development of coins, they were either limited to certain countries or only calculated in retrospect. An index that records, standardises and effectively reflects auction results and coin prices over time does not exist. To fill this gap, the numismatic index, numindex in short, was developed.

What Is a Numismatic Index?

The aim of any index is to present the development of selected prices in a clear and representative way. By pooling items with different but similar features into groups, their average development can be measured and compared to earlier data. This makes it possible to identify the underlying trend and present it visually. A good example is the Financial Times Stock Exchange Index (FTSE), which bundles the largest and most-frequently traded shares at the London Stock Exchange to form a single indicator that reflects whether stock prices are rising or falling.

If this concept of an index is applied to numismatics, such an indicator reflects the price development of selected coins over time. The numismatic index could be used to identify the trend of coin prices. Admittedly, an index does not paint a complete picture of individual areas such as precious metals or time periods. But just like a stock index, it reflects a segment of the market.

Assumptions for a Successful Index

The newly created numismatic index needs fundamental principles to ensure that price developments will accurately be reflected over a long period of time. For the numismatic index, it seems reasonable to make the following assumptions:

- The index will include coins that did circulate. Coins that were exclusively produced for commemorative purposes (so called commemorative coins or collector coins) and never circulated, will only be included in the index in exceptional cases.

- Anyone interested in numismatics should not only be provided with a key indicator but also with the possibility of adding the coins to their own collection (reproducibility). Therefore, each coin in the index must be traded / auctioned off several times a year.

- Each coin in the index must not cost less than EUR 100 and not more than EUR 2,000 at the inception of the index.

- Only those coins will be included that are traded at least 10% above their precious metal value provided that they are in good condition, thus generating a “numismatic plus” on the market.

- The quality (grade) of a coin that is included in the index should be that which is most readily available on the market.

- The prices of the individual coins in the index are based on publicly available information. They are generated in the coin trade and at public auction sales.

Selecting 30 Coins

The assumptions mentioned above provide a good basis to put together the coin basket for the numismatic index as a next step. At this point – and due to its importance – it should be stressed that the acceptance of this index in the world of numismatics is paramount. Only if today’s collectors and dealers, teenagers and novice collectors can be convinced of the concept, will this index be successful. Therefore, the coins included in the portfolio were carefully selected. Numerous interviews and consultations with the most renowned European numismatists were conducted, who suggested the most representative coins for their country.

30 coins were selected for the numismatic index that have a significant connection to the European continent and did in fact circulate. Countries and regions that cannot be found on today’s maps were also considered. Prussia’s influence on European numismatics, for example, is not to be neglected although the state itself does not exist anymore. This fact is not considered a reason to exclude a coin from the potential index universe. To ensure that the coins in the index can be easily compared, only machine-minted coins will be included.

The idea behind the construction of the index was to base it on a specific logical concept and on rules that can be used long-term. Individual countries are represented by specific coins and the selection of the components was influenced by the following aspects: Was the country a member of the Latin Monetary Union (LMU)? If so, the country will be represented in the index by 2 coins. Depending on the number of inhabitants and the possession of potential colonies or special economic areas, the country gets an additional coin. Each of these components has a quantitative impact on the number of coins from a specific country that are included in the current version of the index. The following table reflects the distribution of the coins among the different regions, as applied to the index at its inception:

| Country | LMU | Population | Colony / Zone | Included territory | Total amount of coins |

| Belgium | 2 | Congo | 3 | ||

| France | 2 | Tunisia | 3 | ||

| Italy | 2 | Eritrea | Vatican | 4 | |

| Switzerland | 2 | 2 | |||

| Greece | 2 | 2 | |||

| Austria | 1 | 1 | |||

| Hungary | 1 | 1 | |||

| Spain | 1 | 1 | |||

| Portugal | 1 | 1 | |||

| Great Britain | 1 | India | 2 | ||

| Germany | 2 | GEA | Danzig | 4 | |

| Poland | 2 | Ghetto | 3 | ||

| Finland | 1 | 1 | |||

| Russia | 1 | 1 | |||

| Baltics | 1 | 1 |

The following table applies the guiding principles to the coins of the individual territories.

Following the assumptions and suggestions made above, the numismatic index will start with these thirty coins:

| Country | Denomination | Currency | Year | Mint |

| BEL | 5 | Francs | 1880 | Bruxelles |

| BEL | 20 | Francs | 1914 | Bruxelles |

| COG | 2 | Francs | 1887 | Bruxelles |

| FRA | 5 | Francs | 1871 | A, Paris (Trident) |

| FRA | 50 | Francs | 1858 | BB, Strasbourg |

| TUN | 20 | Francs | 1904 | A, Paris |

| ITA | 5 | Lire | 1848 | M, Milano |

| ITA | 40 | Lire | 1814 | M, Milano |

| ERI | 5 | Lire | 1891 | Roma |

| VAT | 100 | Lire | 1950 | Roma |

| CHE | 5 | Swiss Francs | 1922 | B, Bern |

| CHE | 10 | Swiss Francs | 1911 | B, Bern |

| AUT | 20 | Kronen | 1904 | Vienna |

| HUN | 5 | Korona | 1907 | KB, Kremnica |

| ESP | 25 | Pesetas | 1881 | M, Madrid |

| POR | 1000 | Réis | 1898 | Lisboa |

| GRC | 5 | Drachmai | 1875 | A, Paris |

| GRC | 20 | Drachmai | 1884 | A, Paris |

| GBR | 2 | Pounds | 1887 | London (Jubilee) |

| GBR | 1 | Trade Dollar | 1901 | C, Calcutta |

| DEU | 5 | Mark | 1958 | J, Hamburg |

| GER | 20 | Mark | 1905 | F, Stuttgart |

| GEA | 2 | Rupie | 1893 | Berlin |

| DAN | 5 | Gulden | 1923 | Berlin |

| POL | 10 | Złotych | 1925 | Warszawa |

| POL | 100 | Złotych | 1966 | mw, Warszawa |

| GET | 5 | Mark (receipt) | 1943 | Litzmannstadt |

| LTU | 10 | Litu | 1938 | Bruxelles |

| FIN | 20 | Markkaa | 1910 | L, Helsinki |

| SUN | 10 | Rouble | 1975 | St. Petersburg |

Performance of the Numismatic Index

The index consists of 15 silver coins with a fine silver content of 290.83 grams, 14 gold coins with a fine gold content of 102.66 grams and one aluminium coin from the Litzmannstadt Ghetto with a weight of 1.55 grams.

Considering current precious metal prices, the material value of the coins amounts to about EUR 5,800. Purchase prices for all 30 specimens combined, however, amount to about EUR 13,600. The difference between purchase price and material value is the “numismatic plus”, which is 134% or about EUR 7,800 in this case.

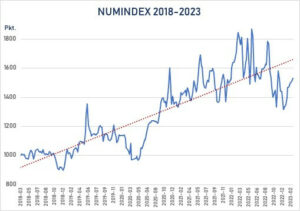

If coin prices of the past 5 years are calculated retrospectively, it is possible to visualise the development of numismatic prices in the index for the coin portfolio described above as follows:

In the first year of 2018, numindex decreased by 10% from its initial position of 1,000 points. Over the following three years, it increased to more than 1,800 points. Although it fell by 450 points within 2022, it has been recovering since the start of 2023 and is now at 1,530 points. The trend (red line) shows a continued positive performance for the past 5 years and the numindex identifies an average annual increase of 9%.

numindex is designed to change the perception of numismatics and put coins at the centre of a collector’s passion. The index is not only calculated retrospectively but, as of now, it will be regularly updated and made available online. It will therefore provide new collectors with a viable suggestion as to what coins to start collecting with.

Moreover, we will regularly provide information about updates of the numismatic index. The current state is available here.

We presented the author, Michael Zagorowski, in our Who’s Who.