by Franky Leeuwerck

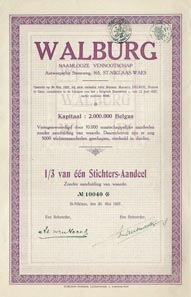

About a decade ago I spotted a Belgian share of the Walburg textile company from the city of St-Niklaas.

Walburg NV was a textile company from St-Niklaas. This 1/3 of a founders share from 1927 mentions a starting capital of 2,000,000 Belgas. Notice the subtle underprint that was printed by St-Michiels Drukkerij, Ledeberg-Gent.

At first sight it looked like a rather plain certificate. But I was puzzled because it was not mentioning the familiar Belgian Franc as its currency denomination but Belgas. Thundering typhoons, what were Belgas?

Albert King of the Belgians. 1 Belga = 5 Belgian Francs, 1932. This nickel coin was minted with Dutch text from 1930 to 1933. The obverse, showing King Albert, was engraved by G. Devreese. More info at http://en.numista.com/catalogue/pieces504.html.

A strong Belgian Franc for King Leopold II

In 1865 king Leopold II was made king of Belgium. In these days most national currencies were made out of gold and silver. In the very same year Belgium, France, Greece, Italy and Switzerland established the Latin Monetary Union (LMU). The LMU countries agreed to change their national currencies to a standard of 4.5 grams of silver or 0.290322 gram of gold (a ratio of 15.5 to 1) and make them freely interchangeable. In this period, which lasted until World War I, the Belgian franc was considered a stable and strong currency, a situation which resembled the international ambitions of the king of making Belgium a more powerful nation amongst other great nations.

Reichsmarks induce Belgium inflation

During World War I the Reichsmark became the only official currency in Belgium. At the end of the war, the Belgian economy was immersed in Reichsmarks and for their exchange against Belgian francs, the government preserved the overvalued currency rate of the occupier. As a result, the war inflation was transferred onto the peace economy, causing prices to increase and the value of the Belgian Franc to decrease.

German Government International 5.5% Loan 1930 in Belgas. Printed by the Reichsdruckerei and issued in Berlin August 15, 1930. This bond was part of the Belgian loan issued in the settlement program for German WWI reparations debts (‘Young Plan’).

The following years saw a continuous fall of the value of the Franc in comparison to the Pound Sterling and the US Dollar, causing further flight of Belgian capital. Eventually, the government Poullet-Vandervelde was forced to resign. Strong measures were needed to stabilize the Belgian currency and to put the evolution of the Belgian national debt back on the right track.

Detail from the bond above which also stipulates: The payment of the coupons and the redemption of the bonds will be effected in Brussels, in Belgas or in Belgian Francs, the Belga being defined for the purpose of this loan in all circumstances by the weight of fine gold determined by the laws now being in force (i.e. 0,209211 gr. for the Belga).

Belgium leaves the Latin Monetary Union and introduces the Belga

At the end of 1925, Belgium, wanting to regain full monetary autonomy, decided to withdraw itself from the Latin Monetary Union by 1927. It would mean the end of the LMU. The Belgian decision meant a clear disruption of its monetary alignment with the French Franc. In 1926, the new government Jaspar works out a stabilizing program for the Belgian Franc. The introduction of the Belga currency was one of several components of the plan. One Belga was equal to 5 Belgian francs. In order to clearly distinguish this new Belgian valuta against the other currencies, especially the French Franc, all exchange operations had to be realised in Belga.

Belga coexists with Belgian Franc

However, the Belgian Franc did not disappear, because the newly issued coins and notes always mentioned their value in both the Belga as the Belgian Franc currency.

This 1943 note for 1,000 Belgian Francs or 2,000 Belgas shows a lace-maker at work. The buildings depicted are: in the middle the Cloth Hall of Ypres, in the left border the Gravensteen of Ghent (‘castel of the count’).

1927 saw appearing the first notes mentioning both currencies and 3 year laters ‘Belga-Franc’ coins appeared on the market. Nevertheless, the plan was a success and did stabilize the Belgian currency.

Vicinal railways company of Congo – unissued 6% 4 year savings certificate of 100 Belgas printed by Imprimerie Industrielle et Financière, 1933.

The new Belgian currency did not last long

During World War II it was replaced by the Reichsmark again. After the war the Belga disappeared quickly but the Belgian Franc remained in use. In fact, on the exchange markets and in daily life, the Belga was never really accepted. Belgians stuck to counting in Belgian Francs. January 8, 1946 saw the official end of the Belga without anyone bothering.

What about Belga on scripophily?

So far, only a handful of these certificates are known and most are scarce. Just to give an indication, I guess that Belga certificates make out less than 0.05 % of the distinct number of Belgian certificates. In most cases, these pieces have a rather dull design, which is probably the main factor why they do not reach high prices.

Between 1924 and 1937 Vicicongo (Chemins de Fer Vicinaux) constructed the Uélé railways (Chemins de fer des Uele) which connected Aketi with Mungbere.

The Belga was not popular when it was used and it was soon forgotten after it disappeared from the market. In the past decades the Belga was seldom mentioned in history lessons at schools, so nowadays few people know about its past existence. And that explains the mystery of the Belga, people simply forgot about the Belga except for collectors of coins and notes and… we, scripophilists will neither forget.

N.B.

I’m not sure if you noticed it, but in contrary to what the Belgian government specified, there is no mentioning at all of ‘Belgian Francs’ on the Walburg share.

The original article written in Scripophily magazine, No. 81 December 2009, also includes a list of known Belga certificates. Check out the International Bond & Share Society if any back issues are available.

References

- The Belga, by the Museum of the National Bank of Belgium

- Ter Beurze, Geschiedenis van de aandelenhandel in België 1300-1990 (English: History of security trading in Belgium 1300-1990), ISBN 90-6966-081-4.

You can find this and other interesting articles on scripophilic topics on Franky Leeuwerck’s interesting blog, called Franky’s Scripophily BlogSpot – Tales of Shares & Bonds.