What was once called “Political Economy” by many, came to be called “Market Economics” for a distinguished few. The movement to put markets back at the centre of economic discussion, led by John Hicks among others, sees the development of markets as logically preceding the circulation of merchandise or formal currency. More to the point, the primacy of the market, over industrialization or capital formation, for example, is posited as a fundamental characteristic of any capitalist economy. And yet, evidence supporting orthodox economic theory in regards to some orderly transition from barter to currency transactions in the context of market economies is scarce.

Money and the Law

A continually growing body of archaeological and anthropological evidence suggests that the functional origins of money were as a means of calculating debt in pre-market (tribal and clan) societies. The earliest forms of money – cowrie shells, and precious metal bracelets, necklaces, and coins – appear to be functioning as measures and stores of value, rather than serving as mediums of exchange.

Historically, monetary accounting systems combined various elements of social technologies and social practices. Having a scale for measuring value based on the payment of debts, and developing an elementary system of bookkeeping (the likely basis of written language) were thus two key innovations in the rise of human civilizations. And so it follows that the development of monies and monetary systems is closely related to the parallel establishment of laws and legal systems.

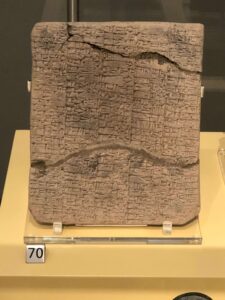

Indeed, our earliest written legal edicts, Esnuuma’s Laws (c.2000 BC) and Hammurapi’s Laws (c.1750 BC), start out by defining basic units of measurement, and by defining acceptable methods for the repayment (or discharge) of accumulated social debts. Babylonian shubati clay tablets (extant from c.2500 BC) represent the acknowledgement of indebtedness, as measured in a unit of account, indicate that “debtor-creditor relations” pre-date the first coins by more than 2,000 years. Thus, well before the production of coins, token measures of material values, and precious metals were probably integrated first as symbols of power and prestige in our first cities.

The Minting of Coins

When the first true, precious metal coins were struck in Lydia (present-day western Turkey) around the seventh century BC it is likely that they were used primarily as status symbols that stored wealth, rather than used as a means of payment and media of exchange. The technology behind their production soon improved, and the usage of these coins spread from Asia Minor to Ionia and the Greek mainland, and may have reached as far as India and China in a trans-continental transfer of revolutionary financial innovation.

We should note that the earliest coins were of mixed weights and purities and did not exhibit any indication of numerical values. Nevertheless, these early coins were probably a convenient medium of exchange with variable exchange rates, and they may also have been used as measure of value (unit of account). A diverse selection of coin designs have been found exhibiting great artistry, often with arresting abstract and natural subjects. Incidentally, the first head of reigning monarch to be customarily minted on a coin is said to be that of Alexander the Great (actually it was the hero Heracles whose face was

first minted, but it became combined and associated with Alexander’s portrait after his death by Alexander’s successors).

The Origins of the Word “Money”

That the word “money” is used today all over the world, derived from Moneta, the temple in Imperial Rome where money was first coined, attests to the enormous influence and power of the Roman Empire. And yet, by the end of Roman times (a long, gradual process starting from 476 in the West, and ending in the East with the fall of Constantinople in 1453) the social and political power which made Roman money acceptable as a unit of account, and encouraged its use as means of payment, had ebbed away. Moreover, relatively sophisticated credit instruments, such as promissory notes (the forerunner of modern bank cheques) which once distinguished “men of money” in ancient Rome, were now seemingly lost to civilization. The deliberate and conscious use of money as an urban, social, and “constructive” technology was decreasing and devolving.

By the thirteenth century or so, the most powerful of Europe’s emerging states asserted their sovereignty by issuing their own monies as their own measures of value. Coins and later credit instruments, such as bills of exchange, were established as abstract units of account that were counted – not weighed or assayed – when they were used as monies. Historically, great shifts in economic and political power have underlain this circumstance or development. Monetary systems are held together by networks of credit and debt relations “underpinned and constituted by sovereignty” that had to be made to work, to be enforced, by authority. The converse is also true: A robust monetary system is essential to the development of a politically strong state. Thus it is no coincidence that the centuries-long “Age of Empires” was preceded by rigorous financial and monetary consolidation in the states of Western Europe.

Towards a New Understanding

In conclusion, centuries of continuous monetary reform and financial innovation seemed to culminate with the establishment of the gold standard in Britain in 1844. Starting out from London, and adopted throughout most of the industrializing world in the two centuries that followed, the gold standard was understood as “a promise, made in an abstract unit of account, to redeem a note for an amount of the precious metal”.

That the exchange rate between the two needed to be fixed and regulated by an authority, and was not “freely” or “automatically” determined by market mechanisms was much less well understood. Unbending fidelity to the notion of money as essentially being just another commodity, and the wider framework of the commodity-exchange theory of orthodox economics, served to blur, if not conceal, the social and political creation of money (and monetary standards) well into the early twentieth century, and maybe as late as the 1970s!

The long, historical “ideological naturalization of money” was achieved with overwhelming success until the abandonment of gold, both as a monetary metal and as a measure of value, brought the entire “fiction of universal, immutable, natural money” into disrepute. A century or so later, and we were still intellectually coming to terms with the end of the gold standard, and the new world of managed currencies, when the Covid-19 pandemic and its attendant financial crises – the most consequential global scourge of our times – once again has forced us to think about the role of money in our lives.

Let’s continue the conversation!

Please look out for the next article in this Numismatist’s Guide to Money series, Mitchell-Innes and the Credit Theory of Money, where Simon Bytheway examines the works of Alfred Mitchell-Innes – a pioneer in the development in the Credit Theory of Money – to find out what his writing tells us about monetary theories, and the wider socio-economic meaning of money.

Author’s note: The thoughts presented here are based on my earlier “Conceptualizing Money: from Commodity Monies to Cryptocurrencies” (2017) article, with thanks to the editors and publishers. I hope to present a full bibliography of sources and additional readings at the conclusion of the Numismatist’s Guide to Money series.

If you missed the previous parts of this series, here you can read part 1: What Does Money Do? And here is part 2: Theories of Money.

For more information on the author, read Simon Bytheway’s Who’s who entry.