The People of Zurich and their Money 16: Free money for free citizens

by courtesy of MoneyMuseum

Our series takes you along for the ride as we explore the Zurich of times past. In this episode you will listen to a conversation conducted in 1934. Werner Zimmermann reasons with a potential investor in WIR bank – a bank that favors a new kind of money.

Much like a good DVD, this conversation comes with a sort of “making of” – a little numismatic-historical backdrop to underscore and illustrate this conversation.

1934. Werner Zimmermann, founder member of the WIR Wirtschaftsring co-operative, tries to win a friend as investor. Drawn by Dani Pelagatti / Atelier bunterhund. Copyright MoneyMuseum Zurich.

Zimmermann: How do you like my Birchermüsli, Hans?

Potential investor: It’s gorgeous, and the sunshine, the clear air. That’s better than living in the town.

The town is a monster eating men. The smog hinders the sun to reach the skin. Look at them, at these pale figures living in Zurich; wrapped in cloth from top to toe. The light and the air can’t reach them. They are pitiable creatures who need our help.

You’re absolutely right. And now tell me about your new project. They say that it has something to do with the free economy movement.

Indeed. To be even more accurate with the free currency movement. The economic crises we are witnessing is caused mainly by those who are hoarding their money instead of feeding it into the economic circulation.

Please, Werner, I’m not a great theorist!

But you have to understand it, Hans. Listen, money has a price, like every other product, a price which depends on supply and demand. If there is a lot of money on the market, then the goods will be expensive, but the economy will prospers and everybody will be employed. If there isn’t enough money on the market, then the economy will come to a standstill, people will loose their jobs and nobody will be able to buy anything, even if the prices are low.

Exactly the situation we have right now.

Indeed. In Germany they have experience with free currency. There the crises began much earlier than it did here. Hence, a German mine engineer created work for the whole district of Schwanenkirchen by inventing the WÄRA. And with a similar free currency they conquered unemployment in Wörgl in Austria.

Come on, let’s invent the WÄRA in Zurich.

Yes, but we have to be careful. The issuing banks will offer resistance as they did everywhere until now. They cling to their currency monopoly. We have to proceed differently, but I’ve an idea.

Tell me!

We’ll found a circle of exchange. Our own internal money will circulate only on the basis of clearing. Then they can’t attack us with legal arguments. What we’re going to do is legal.

And what can I do?

In order to get the project started we need some investors who make money free of interest available to us. Your health food shop is said to be a gold-mine. Would you be willing to help us founding the WIR Wirtschaftsring?

Switzerland. 100 franks 1925 Bern. From auction sale Gorny & Mosch Giessener Münzhandlung Stuttgart Auction 1 (2010) 1238.

Making of:

In the summer of 1925, the Swiss people returned to the gold standard, meaning that every Swiss banknote circulating on the market could be exchanged for gold coins at the National Bank at any time. The commitment to the gold standard, however, also meant that the amount of Swiss money circulating couldn’t be raised indefinitely. It was inextricably linked to the national gold reserve. By that, the Swiss government deprived itself of the possibility to issue a higher number of banknotes if, for some reason, some part of the populace might decide not to spend its money any more but to hoard it instead.

This lack of flexibility became a problem when, at the beginning of 1930, the Great Depression affected Switzerland. By tradition, the major part of the goods manufactured in the Canton of Zurich was intended to be exported, which is why Zurich’s industry suffered the most severe blow when the number orders from the marketing countries dropped.

Between 1929 and 1936, 27 % of the textile plants in the Canton of Zurich were forced to close down, the number of people working in that branch decreased by 45 % with the women and 36 % with the men. Things didn’t look much better in the machinery and metal industry. In 1936, the number of jobless people reached its peak. 20,564 people, i.e. 8.2 % of all people able to work residing in the Canton of Zurich were unemployed.

Hence, the loss of foreign payments for exports resulted in redundancies. The redundancies made the people’s buying power decline. This situation further got worse since many people –being afraid that they might lose their job, too – began to save up money. That, in turn, made dozens of small and great companies, which hitherto had lived on the domestic market comfortably and hadn’t been affected by the Great Depression so far, lose their basis of income. And that again made redundancies necessary. By that, a vicious circle was established against which the Swiss government had no affective means, being committed to the gold standard.

Silvio Gesell. 1895. Photo: Wikipedia.

Many intellectuals criticized the commercial policy of Switzerland back then. The one most influential became Jean-Silvio Gesell (1862-1930), founder of the Freiwirtschaft (free economy) movement. Gesell had used to work as a salesman for dental products in Argentina for years. He had witnessed great difference in prices there, caused by heavy business fluctuations. Gesell searched for a hard rule for the connection of conjuncture and price. One of his results was the theory that money, too, had its price. Like any other good, the price of money depended on the demand: in case there was little money and many goods on the market, its value would increase (= deflation), in case there was much money and only few goods, it would decline (= inflation). By implication, that would mean that a government could boost the business by making money available in the exact quantity needed to buy all goods manufactured. Compared with the traditional money with a value based on its material or gold parity, Gesell labeled his money that was based on the demand as “Freigeld” (free money).

After a successful commercial career Gesell had retired in Switzerland and influenced many enthusiastic people with his ideas. One of those was the protagonist of our conversation, Werner Zimmermann, a teacher from Bern. Zimmermann was a typical representative of his era: happy to reflect and to experiment, an independent mind that disregarded conventions. Born in 1893, he visited the teachers’ training college in Bern between 1909 and 1913. There he was introduced to the progressive ideas of those days, including not only free body culture and vegetarianism but also the concept of Freiwirtschaft, which Gesell himself brought home to Zimmermann. Between 1920 and 1934 Zimmermann travelled the entire world. He studied and analyzed success as well as failure of those experiments with free economy that were conducted at many places in Europe in the 1930s.

Wära advert 1931. Radio set “Lumophon” with the offer to pay in Wära as well. Source: Wikipedia.

In Germany, for example, the “Wära” circulation agency had been established in 1929 that anticipated the principle of all local exchange trading systems to come. The underlying idea was old as the hills. It was based on the barter trade: a farmer, to take up an example from the very first episode, bartered his surplus pigs against the weapons a smith had produced. It is a simple business between two partners, where service is exchanged for a product. Such simple barter operations are hard to imagine in our highly specialized society. A measure of value is required to set the services of a dentist, a barber, a bricklayer against the products of a dealer in food, cars or clothes. That measure of value, however – and this was the revolutionary idea of the local exchange trading system – needn’t be predetermined by the government. If the state refuses to provide enough money the members of a barter club can agree internally on accepting a ‘private’ accounting unit. Any kind of money only works thanks to tacit consent of its users. After all, alternative money, or complementary money as this kind of money is called today, works as good as any issued by the state as long as its users abide by the consent.

That was proved by the successful experiment of Schwanenkirchen somewhere in Bavaria. In 1927, a mine had been closed down which, until then, had been the region’s dominant employer. The result was unemployment and poverty. A mountain engineer ventured to buy the mine and set it into operation again. But he hadn’t enough money to meet the working expenses. He drew on a credit from the Wära currency agency and paid his workers in 90% Wära and 10% public currency. Soon, all local traders were forced to accept Wära and, as a matter of fact, the domestic economy started to flourish in Schwanenkirchen. The experiment was terminated in 1931. The Deutsche Reichsbank was afraid of the competition from Wära for the Reichsmark and enforced the ban.

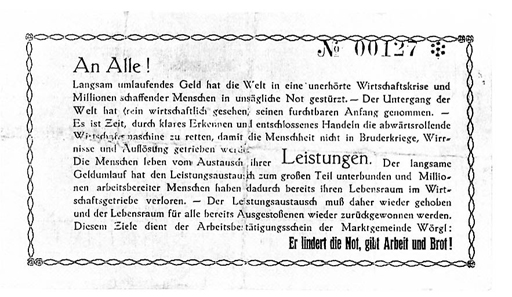

Freigeld from Wörgl. Source: Wikipedia.

Something similar happened in Wörgl where the mayor, on behalf of the community, issued money and, in doing so, not only eliminated unemployment in his borough but, at the same time, also funded substantial investments into the civic infrastructure.

The successful experiment was terminated by the government here as well. The Österreichische Notenbank AG had put the matter to the Supreme Administrative Court which prohibited any kind of private money on November 18, 1933.

Werner Zimmermann knew about these experiments and their failure when he, together with 16 financers and a startup capital of 42,000 franks, brought the WIR Wirtschaftsring-Genossenschaft (Swiss Economic Circle) in Zurich into being in October 1934, just when the Swiss economic crisis was at its peak. Its members agreed upon bartering services and products for WIR, a trade unit whose value equaled a frank. WIR first and foremost was book money administrated as assets by WIR headquarters. Anyone could enjoy such assets by rendering a service, drawing on a credit from WIR co-operation or exchanging cash for WIR. At the beginning of 1935, 1,700 members made use of that already, and the number rose to 3,000 until the end of the year. That year, the directory of WIR members, which was updated regularly, listed 850 categories of products and services. Fairs of trade and local exchange circles provided for a high degree of solidarity to the effect that the turnover of WIR Wirtschaftsring-Genossenschaft exceeded a million already in the first business year.

But: the success of the free money concept, even in Switzerland, brought the bank of issue into the arena. As early as June 24, 1934, it had served as direction under which the “Vereinigung für gesunde Währung” (association for healthy currency) was brought into being. This substantial and politically influential society actively took a stand for the oppression of all of Gesell’s ideas. The Swiss bishops’ conference could be brought to publicly condemn the free economy concept. By that, many priests were gagged that hitherto had been active in fighting for money that wasn’t issued by the state. In 1935, a try was made to prohibit the successful WIR co-operation. That attempt failed; the exchange circle was made a subject falling under the Schweizer Bankengesetz (Swiss bank regulation).

A bigger threat for the campaigners of the Freiwirtschaftslehre was the decision of the Bundesrat from June 19, 1938, regarding the protection of the Swiss currency that threatened to punish those who ‘wilfully spread fictitious facts that might harm the country’s credit or undermine the trust in the country’s currency’. A public court decided what was to be considered ‘fictitious facts’. This made it possible to prosecute the leading theoreticians of the movement. The free economist and senior lieutenant H. K. Sonderegger, for example, was given a dishonorable discharge after a minor lapse while being on duty. The free economist Hans Bernoulli was stripped of his teaching assignment at ETH Zurich in 1938.

At this moment, however, the free economy movement was already past its best. On September 27, 1936, the Swiss government had waived the gold parity and, in doing so, devalued the Swiss frank against foreign currencies. As a result, Switzerland received orders again, unemployment declined, and the business barometer rose again. The necessity of issuing further, private currency became less important because the economy crisis was overcome.

WIR Wirtschaftsring-Genossenschaft, on the other hand, survived. At present, under the name WIR Bank it offers all services of an exchange circle, combined with every service any modern bank renders. In addition, the complementary forms of money experience a surprisingly successful renaissance in our world where the division between rich and poor is always getting sharper.

This was the final episode of “The People of Zurich and their Money”.

You can find all other parts of the series here.

The texts and graphics come from the brochure of the exhibition of the same name in the MoneyMuseum, Zurich. Excerpts with sound are available as video here.