February 14, 2019 – The government of the United Kingdom needed money to pay for its involvement in the First World War (1914-1918). One of the ways it raised funds was by selling war bonds to the public. People bought the bonds as an investment and the proceeds were used by the government. Investors received regular dividends. The Bank of England played a key role in administering the bonds and dividends. Until May 2019, visitors can learn more about this involvement in the special exhibition “Financing the First World War” at the Bank of England Museum.

A photograph of Adela Pratt, one of over 300 temporary female staff employed to work at Moorgate Hall, where the Bank had acquired additional space for processing war bonds. The reference number of this image is 15A13/3/2. Photo: The Bank of England Archive.

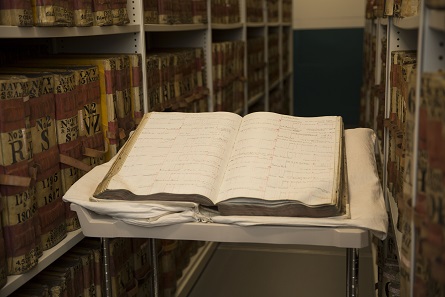

The Bank’s Archive holds over 1,100 ledger recording details of the investors who purchased war bonds. Together they weigh more than 15 tonnes. They cover around 125 metre of shelf space, or 7 times the length of the Stock Office. The ledgers represented on this wall are a life-size reproduction of those in the Bank’s Archive.

A photograph showing an example of one of the war loan ledgers in the Archive. Photo: The Bank of England Archive.

By 1918 the sale of war bonds managed by the Bank had raised four billion pounds. A wider variety of people had money for investments than ever before. The Government marketed the bonds as a patriotic investment.

The display is based on a joint research project by the Bank of England and the School of Geography at Queen Mary University of London. The project was funded by the Arts and Humanities Research Council (Award no. AH/M006891/1)

More information is available on the Bank of England Museum website.